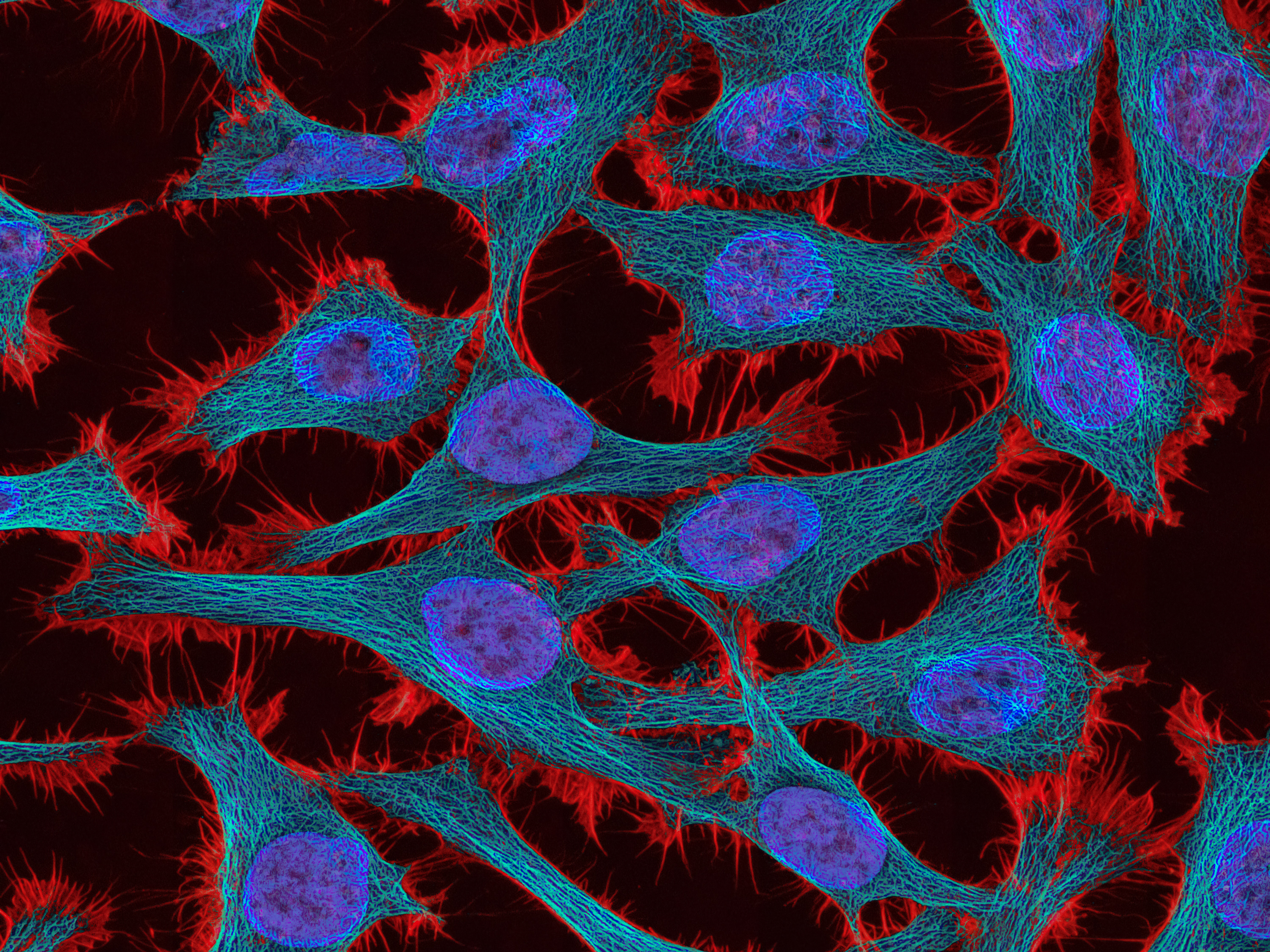

Photo of cervical cancer cells by National Cancer Institute on Unsplash

Pfizer Inc. announced on March 13 plans to acquire cancer drug maker Seagen Inc., an American-based biotech company, for $43 billion. All but one of Seagen’s drugs are biologics, which are often made using biotechnology and derive from living organisms or their cells. The price tags on all of these drugs exceed $100,000 per year.

Pfizer’s CEO was quoted as saying President Biden’s $2,000 cap on out-of-pocket expenses for seniors – a generally unpopular move in the drug industry – means more people will have access to these expensive treatments.

Seagen expects to generate $2.2 billion in revenue 2023. Pfizer believes Seagen could contribute more than $10 billion in risk-adjusted revenues in 2030, with potential significant growth beyond that. Pfizer Oncology has a portfolio of 24 approved cancer medicines that produced a combined revenue of $12.1 billion in 2022.

Seagen’s cancer-fighting portfolio includes four approved medicines for indications to treat solid tumors and hematologic malignancies. Three of these are antibody-drug conjugates (ADCs), a class of biopharmaceutical drugs. They include: Adcetris® (brentuximab vedotin), Padcev® (enfortumab vedotin), and Tivdak® (tisotumab vedotin). The company sells Tukysa® (tucatinib) for patients with severe hepatic impairment and is also used in combination with other drugs to treat breast cancer.

Federal agencies have historically focused on horizontal overlap (i.e., overlap of drugs treating the same issue) when analyzing competition concerns associated with pharmaceutical mergers. However, large pharmaceutical companies are increasingly using the breadth of drug portfolios to harm competition and consumers. These tactics typically involve large drug makers coupling monopoly power in one market with unlawful bundled discounts or exclusionary contracts to force buyers to purchase their drugs across the board.

For example, Johnson & Johnson recently settled an antitrust action in which it was accused of using discount bundling and exclusionary contracts to foreclose competition from a biosimilar medication – an FDA approved drug that is highly similar to a previously-approved proprietary biologic. Likewise, biotechnology company Amgen’s motion to dismiss was denied this past week in a case alleging it used unlawful bundled discounts across its product line to foreclose competition in a single drug market.

Given the change in anticompetitive tactics employed by pharmaceutical companies, federal agencies investigating mergers like Pfizer’s acquisition of Seagen should expand their review to include analysis of whether the combined company will be able to utilize discount bundling, exclusionary contracts or related tactics to foreclose competition. Where the answer is “yes,” they should strongly consider challenging the transaction. Doing so would align pharmaceutical merger reviews with the incipiency standard of Section 7 of the Clayton Act, which makes mergers unlawful where the effect “may be substantially to lessen competition, or tend to create a monopoly.”

Federal agencies should also account for the unique and important role research and development plays in the pharmaceutical industry. There remain countless diseases and conditions that lack effective treatment, making it critical that as many companies as possible work on developing cures. This is hampered by pharmaceutical mergers like Pfizer’s acquisition of Seagen. Unlike before the merger, it is no longer in Pfizer’s interest to develop drugs that replace profitable ones produced by Seagen, potentially stifling innovation in this space and reducing future treatment options for patients.