Antitrust concerns by regulators led to the demise of 29 mergers around the globe in 2018, which was a record year for the number of merger notifications.

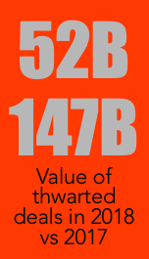

In its Global Trends in Merger Control Enforcement Report, the UK-based Allen & Overy law firm put the monetary impact of these would-be deals at $52.3 billion, with the industry and manufacturing, energy, and transportation sectors getting the most attention. The digital, tech, media and telecom sectors appear to be enjoying less attention than others. "This fits with the concerns raised by an increasing body of commentators who claim a large number of digital and tech mergers are not detected, or that enforcement has been too lax," according to the report.

While the figures are high, this is a dramatic drop from 2017 when 38 deals valued at around $147 billion were frustrated, and are more in line with previous years.

Remedies cases in the US dropped from 23 to 17, bucking a flat trend line, which the report attributes to decreased antitrust enforcement by the Trump Administration. That may or may not be true, especially when it comes to the tech sector. In an Axios interview last year, President Trump said his administration was paying close attention to Facebook, Amazon and Google owner Alphabet, but in the same interview said he was "looking to help" these companies.

Even the most non-partisan observer would agree that the administration has given shifting or conflicting signals on various topics. Some say this is a strategy to "keep everyone on their toes." Critics attribute this to a lack of a clearly defined and communicated policies.

In a speech at a Capitol Forum conference on Dec. 14, 2018, in Washington, DC, Principal Deputy Assistant Attorney General Andrew Finch acknowledged the benefits of these big digital platforms, but rejected calls for breakups merely because markets become concentrated.

"No one can deny the benefits that digital platforms provide," Finch said. "But some people are concerned that a few of today’s leading platforms have become too big, that markets are becoming increasingly concentrated, and they are looking to the antitrust laws to help . . . . I am skeptical of the drastic calls for breaking up firms or turning tech platforms into regulated utilities. Those kind of blunt approaches may ultimately harm the consumers and sellers that we seek to protect . . . . As antitrust enforcers, we do not object when a firm gains market share by competing on the merits, including through superior quality or lower prices. What we do look for is big firms behaving badly by engaging in anticompetitive conduct, such as collusive, exclusionary, and predatory behavior."

MoginRubin Managing Partner Dan Mogin commented, “ When it comes to these large digital platforms, I agree that ‘blunt' remedies may be inappropriate, but I also believe that the antirust enforcement community needs to re-think the meaning of collusive, exclusionary or predatory conduct in this context. To this point, our thinking has been too narrow; particularly the notion of 'price' – if consumer data can be monetized to the extent that it has been, then it's wrong to think these platforms are providing ‘free’ goods or services.”

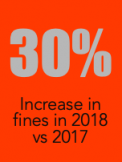

While the number of rejected or abandoned deals decreased compared to 2017, the number of calls for more in-depth investigations increased, and so did penalties. Antitrust authorities continued to break records in imposing fines for skirting M&A regulations, lodging $167 million in fines in 2018, a 30% increase over 2017.

Whether these numbers reflect increasing antitrust scrutinty or less will be something the MoginRubin Blog will monitor throughout 2019.