Since February 2020, staff members at the Federal Trade Commission have been studying past acquisitions by Google, Amazon, Apple, Facebook, and Microsoft – several years’ worth of deals that did not require reporting to antitrust authorities because the deal sizes fell below regulatory requirements. FTC Chair Lina M. Khan says the study reveals “the extent to which these firms have devoted tremendous resources to acquiring start-ups, patent portfolios, and entire teams of technologists—and how they were able to do so largely outside of our purview.” She said the Commission’s enforcement actions have focused on how these companies “buy their way out of competing.”

The study demonstrates the “systemic nature of their acquisition strategies,” Kahn said.

Commission staff have been analyzing the terms, scope, structure, and purpose of transactions between Jan. 1, 2010, and Dec. 31, 2019, that did not have to be reported to federal antitrust authorities under the Hart-Scott-Rodino (HSR) Act. The inquiry focused on 616 transactions valued at or above $1 million, excluding hiring events and patent acquisitions. The companies provided the information in response to special orders from the FTC.

Under the HSR Act, proposed transactions that affect interstate commerce and are valued over a prescribed size threshold must be pre-reported to the joint Pre-Merger Notification Office of the FTC and the Antitrust Division of the Department of Justice. The size thresholds are adjusted each year. For 2021, the HSR threshold for transactions (under which the transaction need not be pre-reported) is $92 million. Reported deals that the antitrust agencies believe may lessen competition “in any line of commerce” or may lead to a monopoly are subject to being blocked by a federal court injunction which the FTC or DOJ obtains by filing a complaint and suing the parties to the proposed transaction.

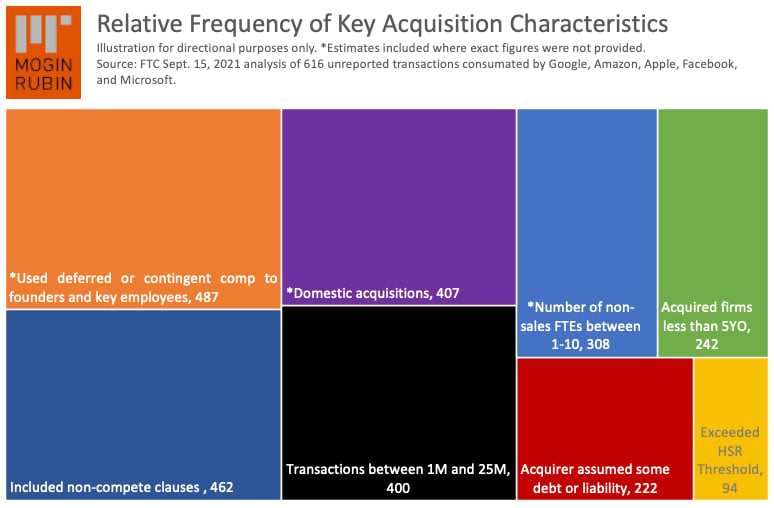

Of the 616 transactions evaluated, FTC staff found:

- 15% (94) exceeded the HSR Size of Transaction threshold. (Although most transactions that exceed the size threshold must be reported, in some instances parties may not need to file if certain other criteria are met or statutory or regulatory exemptions apply, the FTC explained.)

- 36% of the time the acquirer assumed some amount of debt or liabilities. When added to the purchase price of the target, paying off such debts and liabilities would have tipped the purchase amount of three transactions above the HSR threshold. That is, three more transactions would have been added to the 94 transactions already above the threshold, the FTC explained.

- 79% used deferred or contingent compensation to founders and key employees, with relatively small variation across the five respondents. Higher value transactions were more likely to use deferred or contingent compensation. Of the transactions reported, nine additional transactions would have exceeded the HSR threshold (i.e., in addition to the 94 transactions already above the threshold) at the time of their consummation when adding the deferred or contingent compensation to their purchase price.

- 75% included non-compete clauses for founders and key employees of the acquired entities, with little variation in the percentage of transactions that had non-compete clauses across the five respondents. Higher value transactions were more likely to use non-compete clauses.

- 39% involved target companies that were less than five years old.

- More than 50% of the targeted companies had between 1 and 10 full-time employees, not counting salespeople. Employee counts correlate positively with the size of the transaction.

- 65% of the deals were between $1 million and $25 million.

- 66% (roughly) of the acquired companies were domestic.

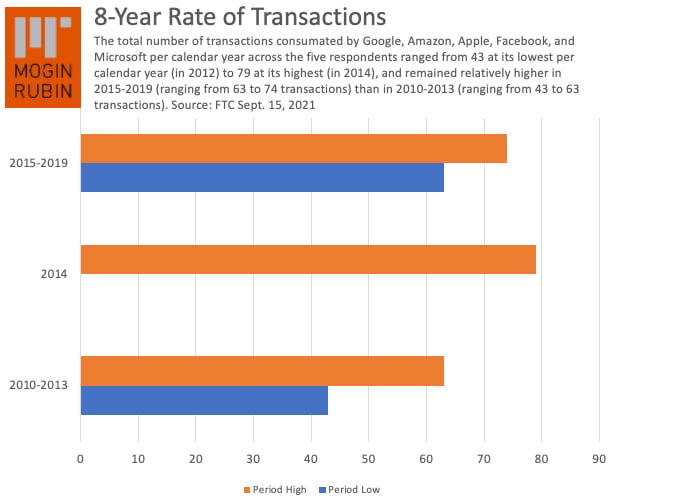

The number of transactions in each of five transaction size ranges – starting at between $1 million and $5 million and ending at between $50 million and the HSR threshold – fluctuated but generally increased between 2010 to 2019. Asset and control transactions, including voting security control and non-corporate interest control transactions, were the most common. Most transactions exceeding $5 million were control transactions, consistent with the observation that higher-value transactions were more likely to be control acquisitions.

The total number of transactions studied per calendar year ranged from a low of 43 in 2012 to 79 in 2014. They remained relatively numerous during 2015 to 2019, ranging from 63 to 74 transactions, compared to 2010 to 2013, when they ranged between 43 and 63 transactions.

The FTC’s retrospective of non-reportable mergers by the dominant digital platforms is a commendable first step toward modernizing the criteria promulgated under the HSR Act for pre-reportability of mergers. The data suggest that the current regulations fail to require reporting of strategic mergers that can have long-run anticompetitive effects. We await with interest the modifications that may be inspired by the revealing results of the Commission’s study.